In this episode, we discuss why window and door manufacturers should be offering customers a B2B financing option. Baxter Lanius is the Founder & CEO of Alternative, a B2B payments company offering simple, streamlined payment experiences. He stops by to explain why.

About Our Guest: Baxter Lanius

Baxter Lanius is the Founder & CEO of Alternative Payments, a B2B payments company offering simple, streamlined payment experiences and helping companies accept online payments for the first time! It's simple to set up and with Alternative Payments, companies are paid 40% faster.

Baxter Lanius is the Founder & CEO of Alternative Payments, a B2B payments company offering simple, streamlined payment experiences and helping companies accept online payments for the first time! It's simple to set up and with Alternative Payments, companies are paid 40% faster.

Connect with him on LinkedIn today!

Q) Why should window and door manufacturers use financing options in addition to existing traditional payment methods? Where's the value?

Baxter: "It's a great question and it's a question that I think is very topical in 2023 for several different reasons. Obviously, the macro environment is more uncertain and the stock market is not performing as well as it previously was.

People are looking for different solutions to drive revenue growth. And what's powerful about driving revenue growth through payment options is you're giving your customers the options to pay in a multitude of different ways, maybe a credit card, maybe an ACH transaction, it may be a wire or it may be financed, but you want to provide your customers a streamlined simple solution to pay you. Then you're going to get paid faster, your customers are going to prefer working with you, and you're going to continue to retain that customer and then hopefully also grow market share with them.

Now, if you go through the kind of payment mechanisms, we're obviously all very aware of credit card transactions and ACH transactions and I'm sure many of the listeners and many businesses utilize ACH and credit cards. On the financing side, it's really a new solution and it's really new for businesses to utilize B2B financing options for their customers, relative to the B2C financing buy now, pay later market, which has been around for a number of years.

We're all very clear and see Affirm and Afterpay and Sezzle, Klarna on several different websites, and I'm sure many of us use it to even pay in four for a pair of sneakers or something that you never thought that you'd ever want to pay for in. But in the B2B space, it's a really, really new market, and only a handful of US companies offer a solution.

Alternative Payments is the only company that offers a holistic solution that includes credit cards, ACH financing, as well as a number of other kinds of reconciliation solutions and integration solutions, which makes it a holistic product. But on the financing side, what this really allows you to do as a manufacturer is it allows you to increase market share with your end customers because now your end customers don't need to pay upfront for a $50,000 purchase.

They can pay over, let's say, five installments or 150 days, let's say, and they can then get paid by their end customer on day 30 or day 60. So it's extremely attractive and a highly positive networking capital impact for these small businesses that are obviously your key customers from the manufacturing angle."

Q) What should window and door manufacturers consider when selecting a B2B financing platform/financing provider to work with?

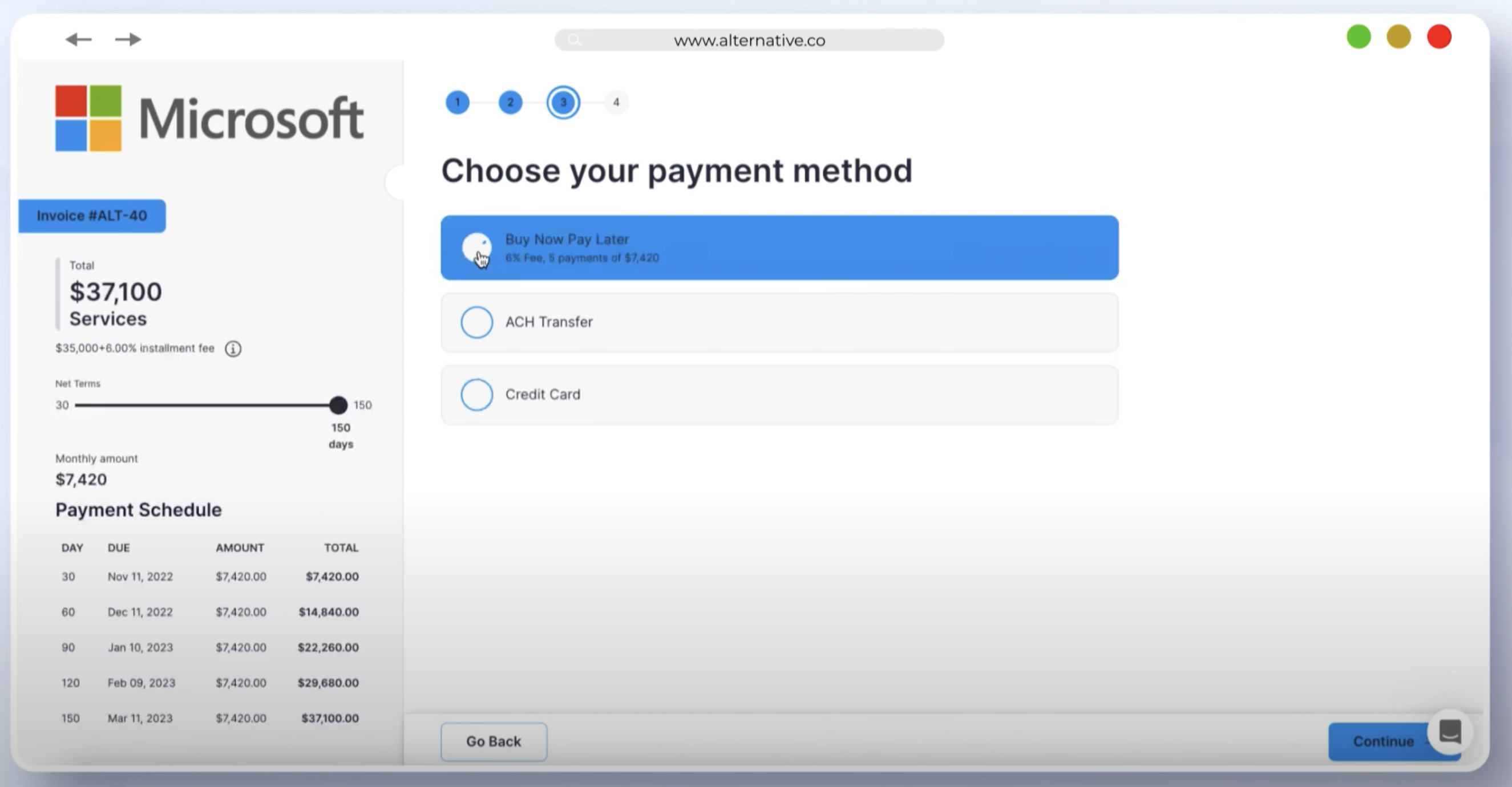

(An inside look at Alternative's Payments Interface)

Baxter: "Yeah, the benefits are obviously there. I think there are a couple of key points in terms of evaluating solutions providers. I mean, there are not that many solutions providers to choose from, but that's beside the point. There will be many more companies in this space.

I think the key piece is if your customer is interested in paying over time for a solution, you want the experience to be simple and streamlined for that customer. You can't redirect that customer to some guy named Joe, who will respond in 72 hours, and you don't know if that deal is done or you don't know if that deal will get complete - and you've lost control of that transaction. That's one kind of key piece.

Simultaneously, point two is that you want a provider who can move relatively quickly and make a decision that allows you to get paid upfront. If you're ultimately holding onto some of the risks as the vendor, then it really doesn't make that much sense because you're accelerating cash flow, but you're also taking all of the risks from the customer not paying.

So where we (Alternative) really comes in (and those are just two points out of a number of other points) is that we offer a streamlined platform whereby the end customer can pay using any of the payment methods that we're all very familiar with like ACH and credit card. But if the end customer also wants to finance it, it's in the exact same user interface and user experience. They see it very clearly. We lay out the terms very clearly. It's a very simple structure. So we charge between 2% and 6%, which is just added to the invoice amount. There are no hidden fees. There are no hidden costs.

Once that transaction is requested, it gets sent for approval. Our approval process is almost 100% automatic and so we're able to make a decision very quickly and then we're able to pay out the manufacturer in typically 24 hours.

For Rizen, we've done a handful of transactions and as Rod said, or before the call, they got paid out the same day, which was obviously tremendous for them because there's no uncertainty, they're getting their cash the same day, and then we're holding onto a hundred percent of the risk for the end customer. So I would say those are the two key value drivers when you evaluate some of these solutions providers.

But really, it's quite a small market today and that's also why we're so excited about the opportunity. Windows and doors, we haven't partnered with a player in the windows and doors space yet because it just hasn't been a huge focus for us, but it will continue to be a big driver of success.

If you're a manufacturer who's offering this, you're definitely going to increase market share because if one of your end customers previously was purchasing from five manufacturers and one manufacturer's offering a financing solution, I would imagine that you're going to continue to generate more of the pie and a bigger relationship with that end customer."

Q) What makes Alternative a choice financing partner for window and door dealers and manufacturers?

Baxter: "So let's take a step back, Jeff, because that's a really great question and let's look at how most businesses invoice and bill today.

Typically, they have a customer, they land a contract, they sign the contract, and they send an invoice to that company to get paid. That invoice could be sent via email. That invoice could be sent via the mail. And typically, within that invoice, there are wire instructions.

Once your end customer receives those wire instructions and that invoice, typically, these bills are net 15, net 30, and in a good scenario, they may be net 60, but you then never know exactly when you will get paid. The end customer could sit on that invoice. They could pay you immediately. They could also pay you on day 45, day 50, and day 60, and it requires a significant amount of manual follow-up to ultimately collect and get paid."

Alternative is so transformational because we reduce that entire process for you and save you a tremendous amount of time by creating a web-based application that can be viewed 24/7 in real-time. We would create that application for you and integrate it directly with your existing invoicing and accounting software, allowing your end customers to log in anytime and view outstanding and due invoices.

They always know where to go. The invoice always gets delivered. It's never stuck in a spam folder. It's never deleted. It's always right there, then, and there. Then, once they click on the invoice and select it, they can pay via their desired payment options. So they can pay via ACH, they can pay via credit card and they can pay via financing.

So instead of just having one payment option within an invoice, the customer has multiple payment options. They can decide when and where to pay, and then all of those transactions are then reconciled directly to your bank account and your accounting platform. So you don't need to constantly be checking, 'did Joe pay me?' We automate all of that. We mark the invoices paid within your invoicing solution.

We recognize revenue within your accounting solution. So we are providing this streamlined functionality for businesses who've never had this solution before, and we implement it quickly. So it's quite transformational to businesses who never knew this existed and spend a lot of money on different operations components. We save a tremendous amount on fees if they cannot collect because we don't charge for ACH.

Credit card fees are passed to the end customer, so our customers are no longer absorbing credit card fees, which is typically a really, really high cost. And then on the financing side, the end customer also absorbs 100% of those fees. So we charge just a monthly SaaS model, and then the end customer absorbs all other payment processing fees.

So that's the last added benefit. I mean, typically, people are not using us because of pricing dynamics. Typically, we never have any pushback on pricing. The former three points that I mentioned really change the game for window manufacturers."

Q) What's the common feedback you get from your clients regarding how Alternative has transformed their company?

Baxter: "So we did an amazing case study last week that we'll actually publish this week or next week, and we spoke to somebody who runs an operations team at a big distribution company. She said we saved her about 20 hours weekly from using our solution.

Now that's just the hourly time. Their cash flow for the month of November increased by 50%. So these numbers are just crazy and they're transformational for a lot of businesses. So there's just so much positive and we're really at the cutting edge of what this solution can do for some of these businesses and what technology can do because what's so exciting about manufacturers is that a lot of their systems are probably not online in some respect, or their payments are not online."

That's in line with what the market is. I mean, right now, about 30% of B2B transactions are still done via check and cash, so companies are not behind the eight ball, but here's the opportunity in 2023 to get ahead of the eight ball and implement an online payment solutions provider and save a tremendous amount of time from your operations team, while also collecting a lot of cash upfront and accelerating revenue growth for your business.

I think this is a great time to be doing this podcast in early January of '23, and there's a lot of excitement in the space and there's no reason why this trend will not continue to grow at a very, very fast clip."

Q) How can our audience learn more - or even try out Alternative?

Baxter: "We'll leave a bunch of resources in the comments section of this podcast for you. You can also definitely check out our website, which is alternative.co. You can find me on LinkedIn at Baxter Lanius, CEO and Founder of Alternative Payments.

We also have our own resources section on our website. There's a bunch of information. We'll be publishing several case studies here shortly and we'll distribute a lot of information. Don't hesitate to email me if you have any questions. My email is baxter@alternative.co, or get in touch on the website."

Subscribe to the "Built to Scale" Podcast for More Window & Door Marketing Resources

Baxter is just one of the many amazing guests we invite to our show - built specifically for window and door professionals!

Baxter is just one of the many amazing guests we invite to our show - built specifically for window and door professionals!

.jpg?length=600&name=045%20-%20YouTube%20Cover%20Art%20(Video).jpg)

No Comments Yet

Let us know what you think